simple¶

-

sim.simple(size, corr_matrix, spec, liquidity, gamma)[source]¶ Generate a simple p-dimensional GARCH(1,1) log-price process with microstructure noise and non-synchronous observation times.

- Parameters

- sizeint

The number of ‘continous’ log-prices.

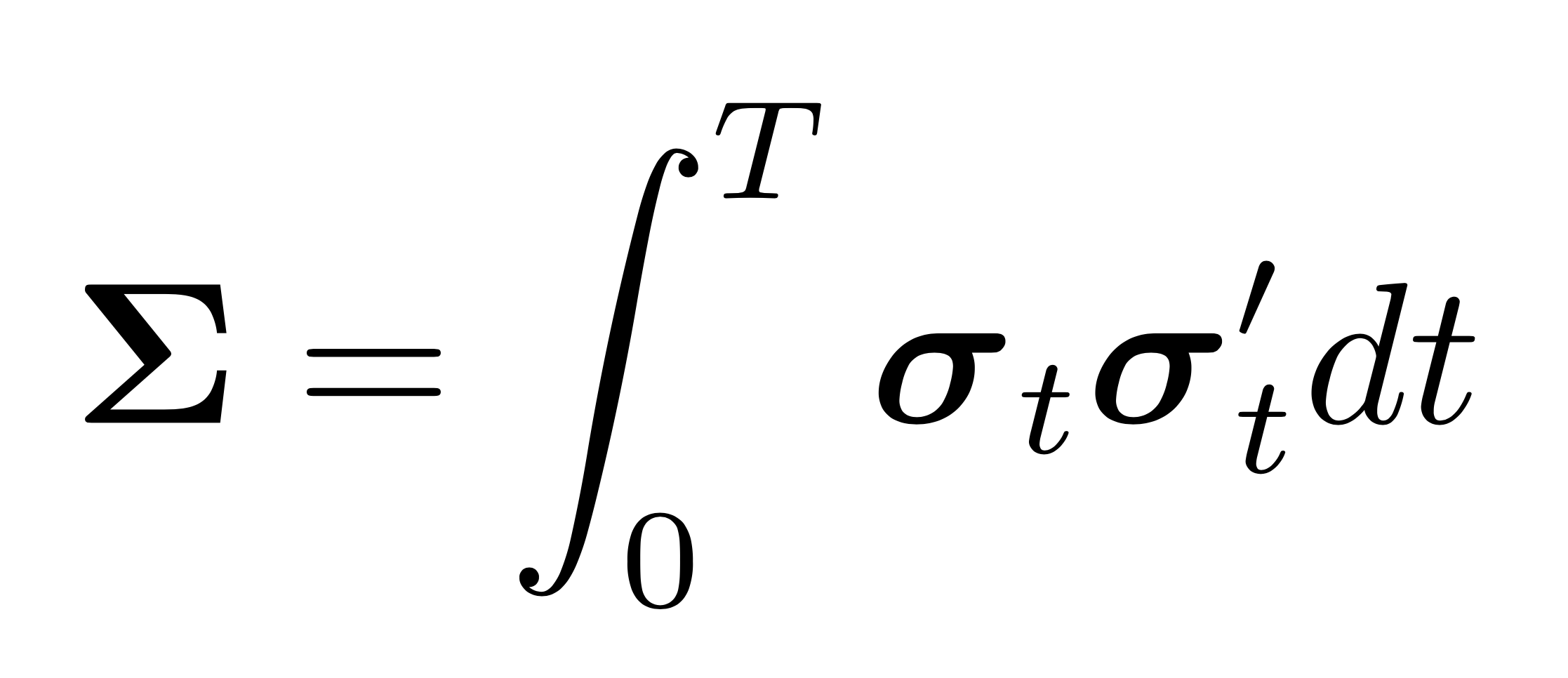

- corr_matrixnumpy.ndarray, shape = (p, p)

The correlation matrix of log-returns.

- speclist

- The garch specification.

[sigma_sq_0, mu, alpha, beta, omega]

- liquidityfloat

A value between 0 and 1 that describes liquidity. A value of 1 means that the probability of observation is 100% each minute. 0.5 means that there is a 50% probability of observing a price each minute.

- gammafloat >=0

The microstructure noise will be zero-mean Gaussian with variance \(\gamma^2 var(r)\), where \(var(r)\) is the variance of the underlying true return process. This noise is be added to the price.

- Returns

- pricenumpy.ndarray, shape = (size, p)

The p-dimensional price time series.